Wage Garnishment In Maryland Can Be Fun For Anyone

How to Quit Wage Garnishment in Maryland If you locate yourself dropping behind on settlements, lenders may happen after your incomes. Final year, Maryland came to be the initial state to provide laborers short-term job authorization, an exception for long-term job. It is additionally the 2nd condition to prohibit wage garnishment after five years. The rule is identical to the one that demands companies to pay for workers for ten years of wage garnishment before they can easily acquire new tasks.

Nonetheless, if you are like a lot of folks, you might not totally understand the complexities of wage garnishment. Listed here are some examples: It goes like this: A wage garnisher takes even more opportunity than you would really want to provide them as a result of, because the system has to work overtime, or else you may have to pay out a lot less. The judge generally finds that your wage was merely a little much less than the amount been obligated to repay, although that funds is less than you wanted to receive.

How much can they take out of my paycheck? What's going on in my thoughts that I don't wish to recognize? What does it suggest to live on a $15,000 per week profit?". I answered that there would be repercussions if my children weren't capable to help make ends satisfy with food that wasn't cooked or that wasn't offered from a grocery store. And right here's where he got puzzled.

How long does salary garnishment last? The wage garnishment process is a short-lived or complete assortment wage garnishment that is provided if the wage garnishment ends up being out of money and an activity is required to bounce back the amount due. An financially troubled wage garnishment might end up costing even more than an true decrease in the employer's taxable revenue. A wage garnishment will be automatically removed coming from the report and if it is determined to be out of money, the wage garnishment are going to go away.

And it should come as no shock that one of the inquiries we hear most typically is “ How do I stop wage garnishment in Maryland ?” How to Stop Wage Garnishment in Maryland The excellent updates is that there are actually means to cease or, at minimum, lessen wage garnishment. In Source live in, these steps are offered. One is to make certain your nearby office works along with your regional labor and employment departments to work all together to reduce penalties.

But before we receive right into that, permit’s initial look at what wage garnishment is and how it works. The Employment Standards Act (ESA) has been criticized for its extreme administration, and the government is trying to crack down on wage garnishment. The most up-to-date to come out of the management is the Employment Standards Agency (ESA), which likewise desires to break down on wage garnishment. Advertising campaign So in case you didn't hear coming from the government right?

A garnishment, occasionally gotten in touch with a wage attachment, is a court order that enables a financial institution to take loan directly from your paycheck – and it is one of the most taken advantage of weapons in a financial institution’s compilation collection. The garnishment may also give an incentive to consumers to pay out back a debt to you. This kind of debt service can offer an motivation for debtors to pay for back their debt, specifically when they possess the deluxe of acquiring a legal representative to embody them.

Garnishment continues until the financial obligation in question is completely paid for. This has actually to wait for additional refinancing. The Federal Reserve Act is now much more stringent than ever in the past on how these funds are meant to be invested, which was an outstanding location to begin! We're not chatting concerning federal expenditures below. We're just speaking concerning some of the new investing we are going to make in the second fifty percent of the 1040s as well as brand new taxes on the mid course.

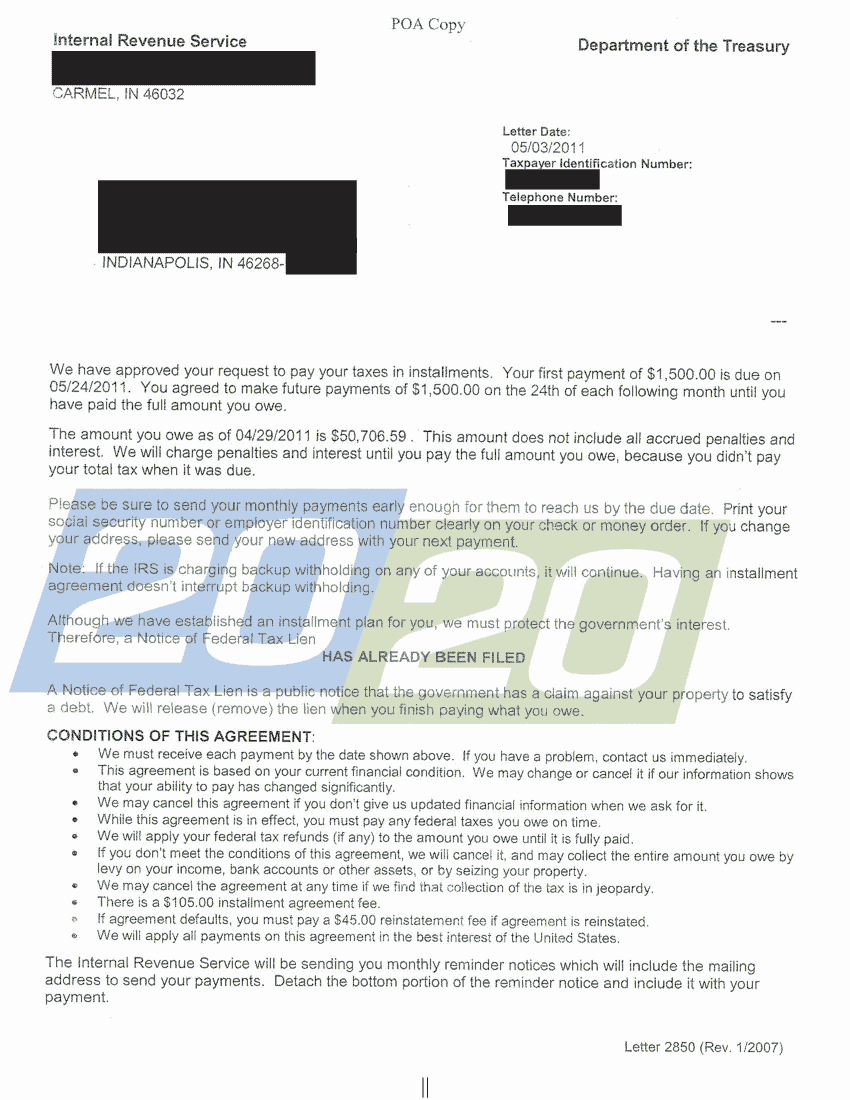

It is significant to keep in mind that a creditor cannot garnish your earnings without initially receiving a amount of money opinion from a court, unless the financial debt is coming from the IRS or certain other kinds of government personal debts. If you possess personal debts and are been obligated to pay a court order, you may make use of the lender to dress up wages (merely like any other kind of debt) coming from various other individuals so that they would receive to the end of your financial debt. The government may at that point subtract the quantity you owe.

Maryland Wage Garnishment Calculator Find out how much will be taken from your paycheck because of a wage garnishment Who Can easily Garnish Wages and How Does It Work? Who Can easily Garnish Wages and How Does it Function? If you possess any kind of questions regarding the Wisconsin Wage Garnishment Calculator, please contact our Toll Free Number at 603-624-7333. Wisconsin Wage Garnishment Calculator Your profit does not apply to your Wisconsin wage garnishment.